The World of Cryptocurrency: Enter the Era of Stability

The world of cryptocurrency has always been thrilling, full of innovation, promise, and, let’s face it, volatility. One day prices soar; the next, they crash. For many, this unpredictability makes crypto feel more like a gamble than a financial tool.

But quietly, amid the chaos, a new kind of digital currency has been gaining ground. It brings balance, trust, and real-world use.

Meet the Stablecoin: The Steady Hand Guiding Crypto Toward a More Stable Financial Future

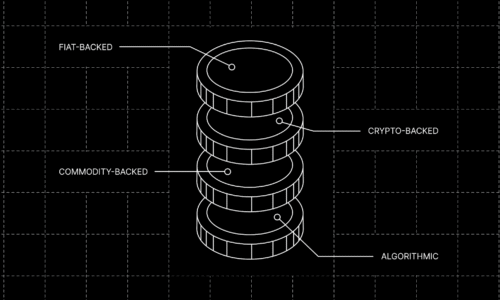

What Exactly Are Stablecoins?

Stablecoins are digital currencies designed to do something most cryptocurrencies cannot: stay stable.

Their value is pegged to a real-world asset such as the US dollar, euro, or even gold. This means that while Bitcoin or Ethereum might fluctuate wildly, one stablecoin is typically worth around one dollar.

In simple terms: Bitcoin is like a roller coaster.

Stablecoins are like the rails that keep the ride safe.

They combine the speed and transparency of blockchain with the trust and familiarity of traditional money. You can send, store, or trade them instantly without banks, middlemen, or long waiting times.

Why Stablecoins Matter

So why all the hype? Because stablecoins bridge two worlds that have long been separate: the traditional financial system and the decentralized digital economy.

Here is what makes them so powerful:

- Faster, Cheaper Payments

Sending money across borders through banks can take days and cost a fortune in fees. With stablecoins, transfers happen in seconds, globally, at a fraction of the cost.

- Financial Inclusion

In countries where access to banks is limited or local currencies are unstable, stablecoins offer a secure way to store and send value digitally. Anyone with a smartphone and an internet connection can participate in the global economy.

- Empowering Small Businesses

Entrepreneurs can use stablecoins to pay suppliers, accept payments, and trade internationally without the red tape of traditional finance.

- Building the Foundation for Web3

In the decentralized internet era, stablecoins fuel digital transactions, lending, and innovation. They make decentralized finance (DeFi) accessible to everyday users.

- The Global Impact

The influence of stablecoins extends far beyond crypto trading.

They are now used by remittance companies, freelancers, e-commerce platforms, and even governments exploring central bank digital currencies (CBDCs).

In parts of Africa, Latin America, and Southeast Asia, stablecoins are already helping people fight inflation and access international markets. They are not just a trend; they are becoming a lifeline for millions living in unstable financial systems.

For example:

- Families use stablecoins to receive remittances from relatives abroad instantly.

- Merchants accept stablecoins as payments to avoid currency loss.

- Savers hold digital dollars to protect their earnings from local currency devaluation.

This is financial innovation at its most human level. It is technology solving real-world problems.

The Challenges Ahead

Of course, stablecoins are not perfect. They rely on strong reserves, transparent audits, and trust in their issuers. Regulatory frameworks are still catching up, and questions about security, oversight, and monetary control remain.

Yet, despite these challenges, the direction is clear. The world is moving toward a digitally connected economy, and stablecoins are paving the way.

The Future Is Stable

In the grand story of money, stablecoins represent a turning point. They are not here to replace national currencies or compete with banks; they are here to modernize how money moves.

They bring speed where there was delay, access where there was exclusion, and transparency where there was doubt.

The future of finance is not just digital. It is stable.

helina

hi