Tokenized Deposits vs Stablecoins: Two Paths Toward the Future of Digital Money

The global financial system is quietly undergoing one of the most important transitions since the introduction of electronic banking. Money is becoming programmable, borderless, and increasingly digital. At the center of this shift are two concepts that are often discussed together, yet are fundamentally different in design, purpose, and long-term implications: tokenized deposits and stablecoins.

While both aim to modernize how value moves in the digital economy. They represent two very different philosophies about trust, regulation, and the role of traditional financial institutions. Understanding the difference is not just a technical exercise. It shapes how countries, businesses, and individuals will interact with money in the years ahead.

What Are Tokenized Deposits?

Tokenized deposits are traditional bank deposits that have been represented on a blockchain or distributed ledger. In simple terms, they are the same money people already hold in their bank accounts, but issued in digital token form.

A key point is that tokenized deposits remain liabilities of regulated banks. They are backed one-to-one by actual deposits and exist within the existing banking system. The difference lies in how they move and how they are settled. By using blockchain infrastructure, tokenized deposits can enable faster settlement, improved transparency, and programmability, all while staying within regulatory and supervisory frameworks.

From the perspective of trust, nothing fundamentally changes for the end user. The same bank stands behind the deposit, the same rules apply, and the same legal protections remain in place. What changes is efficiency.

This is why many financial institutions see tokenized deposits as a natural evolution rather than a disruption. They allow banks to modernize their infrastructure without abandoning the core principles of the current financial system.

What Are Stablecoins?

Stablecoins, on the other hand, emerged from the crypto ecosystem as an alternative form of digital money. They are blockchain-based tokens designed to maintain a stable value, usually by being pegged to a fiat currency such as the US dollar.

Unlike tokenized deposits, stablecoins are typically issued by non-bank entities. Their backing varies. Some are backed by cash and short-term government securities, others by crypto assets, and some rely on algorithmic mechanisms.

Stablecoins introduced a powerful idea: the ability to move value globally, instantly, and without relying on traditional banking rails. They became foundational tools for decentralized finance, cross-border payments, and on-chain trading.

However, this innovation also raised critical questions. Who is responsible when something goes wrong? How transparent are the reserves? What legal protections exist for users? These questions have pushed regulators around the world to take a closer look.

The Core Differences

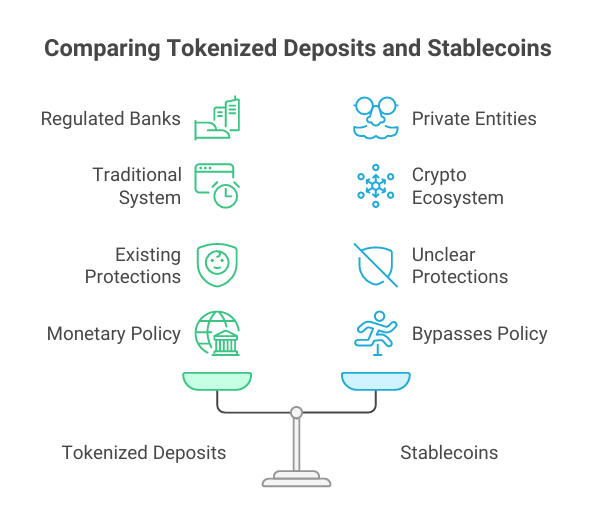

Although tokenized deposits and stablecoins may look similar on the surface, the differences beneath are significant.

Tokenized deposits are issued by regulated banks and sit fully within the traditional financial system. Stablecoins are usually issued by private entities operating alongside or outside that system.

Tokenized deposits inherit existing consumer protections, compliance requirements, and monetary policy transmission mechanisms. Stablecoins challenge these structures and, in some cases, bypass them entirely.

In essence, tokenized deposits prioritize continuity and stability, while stablecoins prioritize openness and speed.

Why This Distinction Matters Globally

As digital finance grows, governments and central banks are increasingly aware that money is no longer just a medium of exchange. It is infrastructure.

Tokenized deposits offer a way to modernize financial plumbing without fragmenting the system. They align closely with regulatory objectives, financial stability goals, and existing monetary frameworks.

Stablecoins, meanwhile, offer innovation at the edges. They have proven especially useful in regions with limited access to banking, high remittance costs, or unstable local currencies. Their success highlights real gaps in the current system.

The debate is not about choosing one over the other. It is about understanding which tool fits which purpose.

A Subtle Lens on Africa and Emerging Markets

In emerging economies across Africa, the conversation around digital money carries additional weight. Financial inclusion, access to capital, and trust in financial systems are not abstract ideas. They influence trade, entrepreneurship, remittances, and everyday economic participation.

Across the continent, large segments of the population remain underbanked or entirely outside formal financial systems. At the same time, Africa has consistently shown an ability to leapfrog legacy infrastructure. Mobile money adoption, agent-based banking, and digital wallets have reshaped how people interact with money, often faster than in more developed markets.

Within this broader African context, countries like Ethiopia offer a useful illustration of both opportunity and caution. Ethiopia’s financial sector has historically been tightly regulated, with a strong emphasis on stability and gradual reform. Yet digital payments, mobile wallets, and fintech innovation are steadily gaining ground as the economy grows and becomes more connected.

In such environments, tokenized deposits may represent a practical and familiar path forward. They build on existing banking systems and regulatory structures while quietly improving efficiency, settlement speed, and interoperability. For policymakers and institutions, this approach aligns with a preference for controlled innovation that strengthens, rather than replaces, existing financial foundations.

Stablecoins, however, highlight a different set of realities across Africa. Their adoption in various markets points to persistent challenges such as high cross-border transaction costs, limited access to foreign currencies, and friction in global trade. Even where their use is informal or constrained, stablecoins signal demand for faster, cheaper, and more accessible financial rails.

The long-term opportunity for African markets lies not in copying any single model, but in selectively combining strengths. The stability and trust of regulated systems can coexist with the efficiency and openness introduced by blockchain-based tools. The task ahead is to shape frameworks that encourage innovation while protecting users and maintaining financial resilience.

The Role of Web3 and Real-World Adoption

The rise of tokenized deposits and stablecoins also reflects a broader shift in Web3. The focus is moving away from speculation and toward real-world use cases.

Tokenized deposits represent institutional adoption of blockchain technology. They show how decentralized infrastructure can be used pragmatically, behind the scenes, to improve existing systems.

Stablecoins represent grassroots adoption. They grew because they solved real problems before institutions were ready to act.

The future of digital finance will likely involve convergence. Bank-issued digital money may coexist with privately issued stablecoins, each serving different roles within a shared ecosystem.

Looking Ahead

The question is no longer whether money will be tokenized. It already is.

The real question is who issues it, how it is governed, and who benefits from its design.

Tokenized deposits and stablecoins are not competing visions so much as complementary experiments. One modernizes the core of the financial system. The other pressures it to evolve.

For countries navigating growth, innovation, and inclusion, the path forward will require balance. Moving too fast risks instability. Moving too slowly risks irrelevance.

Understanding these tools deeply is the first step toward using them wisely.

The future of money is not only digital. It is intentional.